bimmerpost/

G87 / G42

BMW M2 and 2-Series Coupe

| 01-05-2012, 02:00 PM | #2487 |

|

Private First Class

275

Rep 123

Posts |

1330-1340 Theory still viable. Markets seem to want to reach higher, even on down days. Financials rallied hard today cause of mortgage-backed resolutions, most of the other sectors are under-performing in comparison though.

I'm still expecting a crash/correction soon.

__________________

|

|

Appreciate

0

|

| 01-09-2012, 12:13 PM | #2488 |

|

Private First Class

275

Rep 123

Posts |

Week Highlights:

Wednesday (Likely bottom of the trading week): - US Bond Auctions, - German 2011 Real GDP release. Likely revision DOWNWARD from 3.6% to 3.0%. [1PM PT, 4PM ET] Thursday: - ECB Interest rate cut announcements. Not really expecting any further cuts from Draghi, which "could" see a rebound in Euro dollar sell-off. More "disguised QE's" from ECB though will devalue the Euro more. I.E, unlimited 3-year borrowing plans recently initiated by ECB. [4:45 am PT, 7:45am ET] - US Retail Sales. Likely to rise a little bit. Crucial data to come from this, as Consumers + Industry is how we'll get back recovery (but, imho, both are a few years away from really being the backbone of this recovery). [5:30am PT, 8:30am ET] Don't forget the Spanish and Italian bond auctions Thurs/Fri. P.S. 1330-1340 targets are still viable. But keep in mind that many people are watching these levels and that the trading environment, by-and-large, is in cautious mode right now. I wouldn't say SPX 1290 is a bad exit-price, as we may peak there (unless there was a strong desire to push forward, but I dont see it yet). People are likely going to sell-off earlier than expected. I think the Jan 25th FOMC meeting isn't likely to result in QE3. Bernanke is a character "KNOWN" to "surprise" markets with fiscal policies (i.e, that day we saw the central banks unite in what resulted in a +500 point swing on the DOW). Dissapointment there. Plus, no EU fiscal resolution till March now. Window is wide open.

__________________

|

|

Appreciate

0

|

| 01-10-2012, 05:50 PM | #2490 |

|

Captain

126

Rep 876

Posts |

Have been calling for long side for over 2 months...has chopped up for the most part...after this week, no longer going to be bullish...gonna put in major top soon...not many will expect it.

Im prob not going to post much anymore...you mofo's are on your own!...  ....GL in 2012. ....GL in 2012. |

|

Appreciate

0

|

| 01-10-2012, 08:12 PM | #2491 |

|

UNC FTW

28

Rep 741

Posts |

So in 6 days I have to invest $1,000,000 in ETF's using Market Watch's simulator with a 20 minute delay. Just curious what you would do and how would you trade? Any tips on how to make big gains using the simulator? Any tricks or hints would be appreciated.

|

|

Appreciate

0

|

| 01-11-2012, 05:35 AM | #2493 |

|

Private First Class

275

Rep 123

Posts |

Put it all into under-valued short ETFS like TZA and TVIX.

__________________

|

|

Appreciate

0

|

| 01-11-2012, 03:47 PM | #2495 |

|

Troll but nice

166

Rep 341

Posts |

I dont like what the BDI shows ...

__________________

There was me, that is Alex, and my three droogs, that is Pete, Georgie, and Dim, and we sat in the Korova Milkbar trying to make up our rassoodocks what to do with the evening. The Korova milkbar sold milk-plus, milk plus vellocet or synthemesc or drencrom, which is what we were drinking. This would sharpen you up and make you ready for a bit of the old ultra-violence.

|

|

Appreciate

0

|

| 01-12-2012, 09:50 PM | #2496 | |

|

Private First Class

275

Rep 123

Posts |

Quote:

Go on...

__________________

|

|

|

Appreciate

0

|

| 01-12-2012, 11:06 PM | #2498 |

|

Banned

56

Rep 1,739

Posts

Drives: 2008 Z4MC

Join Date: Aug 2010

Location: Seattle, Vancouver

|

|

|

Appreciate

0

|

| 01-16-2012, 09:20 PM | #2500 | |

|

Major

55

Rep 1,166

Posts |

Quote:

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

|

Appreciate

0

|

| 01-16-2012, 09:42 PM | #2501 |

|

Lieutenant

30

Rep 480

Posts |

check out www.wrightinv.com , we do a lot of in depth fundamental and technical analysis surrounding foreign exhange, equities, rates, and commodities. Just another site to compare and contrast for my fellow car enthusiasts

|

|

Appreciate

0

|

| 01-17-2012, 01:09 AM | #2502 | ||

|

Private First Class

275

Rep 123

Posts |

Quote:

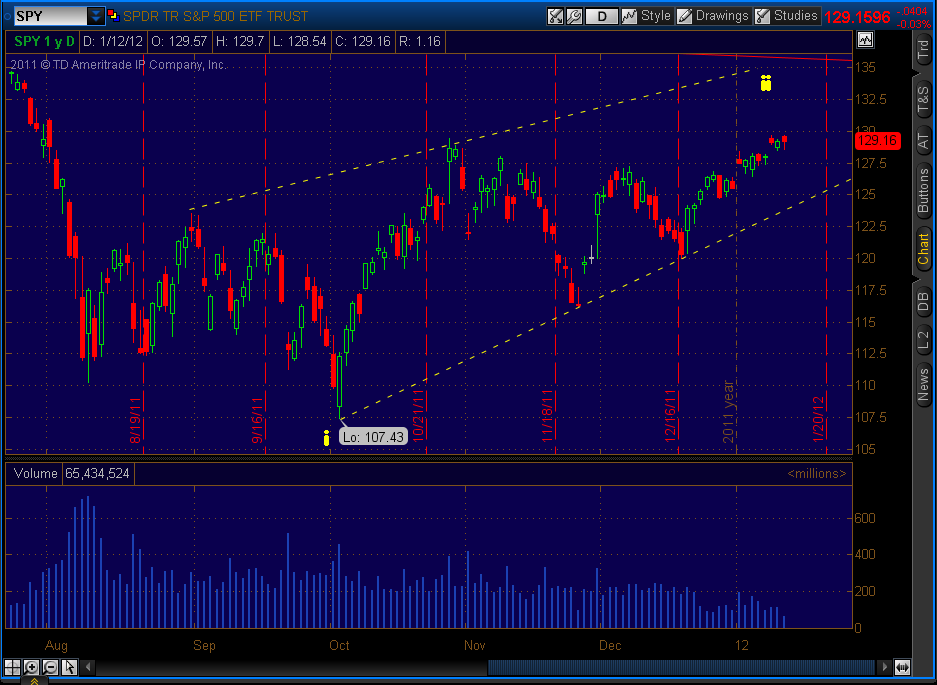

All-in-all, my opinion is that this market is on it's way down. I don't care for the analysts or market professionals declaring this a Secular Bull run and that we should pump money into the market or miss out. I'm not buying in on the top. That's rule #1. I short on the top. My honest guess at why the market has been up in January? 401k Money. Once the 401k's come invested into the markets, I wouldn't be surprised seeing Europe resurface and the market crashing, with 401k money exchanging hands right into WallStreet. Just my personal opinion, of course. Correction Time:  Here's an image I'm linking from somewhere else, but pay attention to the volume decrease from the Oct. 3rd lows of 1074 up till the January highs we're at currently. Volume is decreasing. This is not text-book definition of a bull-run on WallStreet. This is text-book definition of a corrective rebound in a Bear Market. Furthermore: Quote:

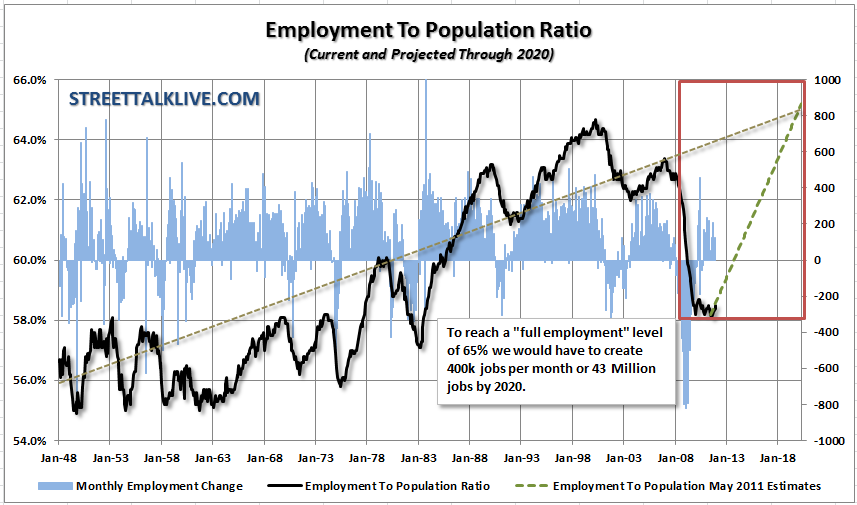

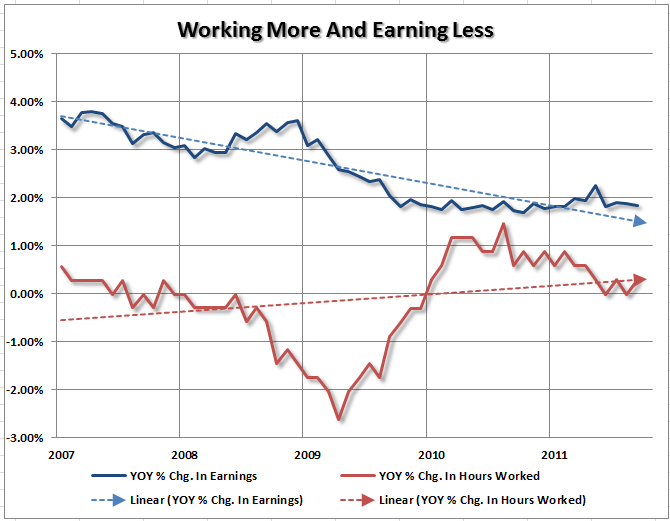

We have financials rallying this 2012 year, which is something we havent had in the last few quarters in 2011. BAC ran as high as +27% YTD, but as of Friday I believe it's closed around only +19%. There's already a change-over of longs to short positions, imo. JPM earnings came out on Friday and they were slaughtered last year with a -45% loss in revenue. And they were considered one of the "best" financial institutions out there currently admist a sea of laggard firms. This trading week we'll see earnings for the less spectacular banks. I'm not seeing this rally being supported by the financials much after their earnings come. I am short this market currently. Should the market break in either direction, up or down, it will be a major break. I just happen to be on the side for a breakdown rather than a breakout. I see no reason for the markets to improve, only for Bernanke to keep it from falling apart and catching the falling knife. I just happen to think there's more knives to catch than Bernanke has hands.  P.S. With the Eurozone downgrades and France and Austria losing their prime Triple A's, the EFSF backed by those tarnished AAA countries also got cut down to AA+. What does that mean? Means either the EFSF has to reduce the amount of money it can back ($440billion currently) to $260B Euros, or get more Triple AAA countries to pump more backing money in. Who really thinks Germany is going to back more money in? They have no intentions (I believe) of muscling out $200B+ Euros of Tax payer money. That = Political suicide. So of the $260B remaining, $40B has already been given away and $130B needs to go to Greece. Do the math. The EFSF isn't $440B anymore, it's only $90 Billion. Think about it. $90 Billion to cover Portugal, Italy, Spain, etc? Projections to STABILIZE the EU is at around $1-2 Trillion Euros into the EFSF. The actual estimate is in the $3.5-4 Trillion Euro mark. Even if you factor in the ECB's 3 year lending contracts at $460 Billion (of which 99% in back-logged into the ECB safety vault by the same banks who took those loans), and we are playing a game of chicken. Chickens are going to come back to roost. Not to mention the Straits of Hormuz are continually headed down the wrong direction and sanctions have already been implicated by the big nations around the world. Most of Asia is already trying to find alternatives to Iranian Oil and Saudi Arabia is going to pick up the slack since it can pump up 12.5 Billion gallons a day to over. But who are the three largest users of Iranian oil in EU? Portugal, Spain, Italy.  It's just a mess. It's just a mess. Two things you need to jump start this market: 1) Consumer Spending, and 2) Housing Market. The first is self-explanatory. Credit Card debts are, as of December, maxed at 151% capacity for the average American. The 200,000 TEMP jobs Obama keeps flaunting as a recovery in his economy is a red-herring. It's not there. And this month's employment report showed that increase back up to 399,000 jobless claims. Trend line Break, anyone? So what does the job sector need to see in terms of, say, just recovering to pre-08 levels? Let's look at an 8 year forecast. Surely, by 2020, the job sector must be better, right? Look here:  For employment to even RETURN to pre-2008 levels, bringing with it increased disposable consumer income and savings, by 2020 we'd need to create 400,000 a month! I believe that kind of growth has never existed in history (though someone correct me if my data is wrong). I dont believe even WWII created the amount of jobs we'd need for this recovery, seriously. But all of you out there, working, know that the roughly 120,000 jobs being created currently have decreasingly lower wages:  SO WHERE, in this picture I have of the economy, will we keep afloat the US economy so dependant on 70% consumerism? Less jobs and lower pay? And WallStreet and Goldman Sachs are preaching over news-stations round the clock about how 2012 is the year of the Bull? DON'T FALL FOR IT. As for housing, at-best it will just bottom out after four years in decline: finally. Fed projections are usually ultra-conservative and their FOMC Minutes from just last Quarter 4 in 2011 showed expected recovery in Housing sometime 2013-2014.  [Being honest here, this fact is being recovered by memory. It's fuzzy cause I read it 1.5 months ago. Could be 2020 projections, actually.] [Being honest here, this fact is being recovered by memory. It's fuzzy cause I read it 1.5 months ago. Could be 2020 projections, actually.] Just felt like informing you guys lately. I havent written a good post on here in a while.

__________________

Last edited by Vanity; 01-17-2012 at 01:49 AM.. |

||

|

Appreciate

0

|

| 01-17-2012, 03:17 AM | #2503 |

|

Private First Class

275

Rep 123

Posts |

Shanghai Composite is up 4.2%. Growth is at 2.5 year low. But what about the good GDP number coming out from China? The production output of that country also includes the 65 million newly-developed homes that vacantly litter the countryside.

Massive rally entails a massive plunge. Just my opinion, of course. Anywhere from 1-5% left in this market, before this rally reverses course and ascends into Hades. Also my opinion.

__________________

|

|

Appreciate

0

|

| 01-17-2012, 04:16 AM | #2504 | |

|

Major

55

Rep 1,166

Posts |

Quote:

. With the way things are headed in my opinion, the downside of the market is MUCH larger then the potential upside, so like your self, I also currently holding a short position (SPXU). Here is a good article that literally jus got up 9 mins ago from the time of this post from Bloomberg: . With the way things are headed in my opinion, the downside of the market is MUCH larger then the potential upside, so like your self, I also currently holding a short position (SPXU). Here is a good article that literally jus got up 9 mins ago from the time of this post from Bloomberg:http://www.businessweek.com/news/201...downgrade.html And as you ended you post with DON'T FALL FOR IT. I couldn't agree more total bull sh*t happening right now in the global market place and in my opinion kind of risky to even trade in.. but what can i say haha the potential is worth it  oh and also: But all of you out there, working, know that the roughly 120,000 jobs being created currently have decreasingly lower wages the way this trend is going..scary stuff not looking forward to graduating from college and looking for a job

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

|

Appreciate

0

|

| 01-17-2012, 05:21 AM | #2505 | |

|

Private First Class

275

Rep 123

Posts |

Quote:

Oh, nice SPXU hold. What entrance price did you get in on it at? And yeah, I figure there's a much larger upside in shorting this market than there is upside left going up. I think there will be jobs still, but competition is going to increase dramatically. But hey, this world is all about "who you know" and not "what you know". Looks like tomorrow is going to stage a rally, looks like a rally that might actually drag in good volume too. Hopefully after retail investors get in we can cash in some good Short-money.  Trading range: Upside: 1305 or 1316 (could see pullback at either of the two), but the highest I'd put this rally is at 1330. I really think the correction is due. Everything is way overbought, and tomorrow's rally is going to push the overbought status off the registered range  Bullish signals coming in on shorts I follow, so, Can't time the markets dead on, so getting the correction in-or-around a week is good enough for me. Bullish signals coming in on shorts I follow, so, Can't time the markets dead on, so getting the correction in-or-around a week is good enough for me.  *fingers crossed*. *fingers crossed*. Downside: 1250 or 1255. A lot of put options are camped there. Thats about an initial 4% pullback. Enough for a correction upwards, but we've been down as low at 1074 so it's not a stretch of the imagination by any means saying we'd definitely be back there again.

__________________

|

|

|

Appreciate

0

|

| 01-17-2012, 10:02 AM | #2506 | |

|

Captain

126

Rep 876

Posts |

excellent post Vanity...saw we were going higher last week and went long TNA and AGQ...rising wedge should grind higher but looking at 1320-30 as the top...we shall see.

Quote:

|

|

|

Appreciate

0

|

| 01-17-2012, 12:19 PM | #2507 | |

|

Major

55

Rep 1,166

Posts |

Quote:

. .

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

|

Appreciate

0

|

| 01-18-2012, 01:19 AM | #2508 |

|

Major

55

Rep 1,166

Posts |

Penny Stocks

First im not dumb enough to trade penny stocks, due to them not being liquid enough because of there low volume. Also, LOL the potnetial losses in them are just not worth it First im not dumb enough to trade penny stocks, due to them not being liquid enough because of there low volume. Also, LOL the potnetial losses in them are just not worth it  Ive been getting email from this sight called Pennypic.com and well lol i decided I would monitor one of their picks for once just for the hell of it (didnt trade just watched). Ive been getting email from this sight called Pennypic.com and well lol i decided I would monitor one of their picks for once just for the hell of it (didnt trade just watched). After I decided I would monitor it i decided to look into the fine print of the email and found this  : :Anyway lol even with that I decided to watch it for fun lol and damn this stock got quite a bit of volume for a penny stock and kept gaining, pretty shocking haha wasnt expecting that. Now im not sure if its going to tumble or actually go with their prediction towards over one dollar. Either or wont be trading it. So whats your guys'es opinion on penny stocks, Ive always seen them as scams but who knows ahhaha

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|