bimmerpost/

G87 / G42

BMW M2 and 2-Series Coupe

| 05-10-2023, 08:18 AM | #7921 | |

|

Major General

10866

Rep 9,053

Posts |

Quote:

- Sales / Purchases completely grinding to a halt... - realtors, loan originators will have to look for other work - unemployment will tick up - inventory will still be low - hence again, people that bought at low rates will be stuck forever... people that didn't buy won't find it valuable to buy - housing starts and construction will grind to a halt In other words, all of this will just translate into a BAD economy for everyone and housing will drop... just unclear how low but I am already seeing houses sit for 4-5 months that LY would have sold in days w 10 people making offers. This is FL btw... the most competitive market. People are still hesistant to adjust pricing which is completely unrealistic given the market... i just saw a new build $100K off from a year ago and still no one wants it.

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

| 05-10-2023, 08:51 AM | #7922 | |

|

Private First Class

322

Rep 151

Posts |

Quote:

Between 1995- 2008 mortgage rates ranged between 6.6% - 9.25%. They dropped to sub 5% in 2009 and dropped to 2.6% during COVID. I think rates will stay higher for longer and this is going to cause some cascading pain for multiple industries - CRE and residential being primary beneficiaries of this pain. Issue right now is that there's no inventory: 2/3rds of mortgages right now are with sub-4% mortgages. Getting these owners to trade up to a near 7% rate is going to be hard, especially if prices haven't re-aligned. Over the last 2 years, over $300 billion in cash out re-fis occurred in the residential market. Arguably, this has helped consumers keep up spending. If home values begin to re-price down, this hoovering up of liquidity is going to be felt broadly. Sadly, I think we're just in store for a slow motion economic beating that's got legs to run for a solid 10+ years, unless we hit a Minsky moment and the rug gets pulled out suddenly. If that happens, all bets are off. |

|

|

Appreciate

1

ASAP10866.00 |

| 05-10-2023, 03:07 PM | #7923 |

|

Major General

3654

Rep 9,783

Posts |

I’m starting to have doubts that the housing market will crash. I’m hoping in order to jump in. It’s simply unaffordable right now. Don’t know how much faith I should place on articles saying housing is rebounding, but homes around here are still going fast and prices haven’t come down that much. Could also be the Spring and Summer thing where there’s simply more sales.

|

|

Appreciate

1

antzcrashing1966.50 |

| 05-10-2023, 04:09 PM | #7924 | |

|

Private First Class

1322

Rep 135

Posts |

Quote:

Until we get much higher unemployment, which will force people to sell because they're moving for a new job, or they can't pay the note, or they're retiring, or some other factor, we won't see inventories change much. Because who with a 3% loan is going to give that up willingly, especially if prices haven't adjusted to the new cost of money? Personally, I've got a 2.125% note and I guarantee you I'm going nowhere. Well, at least not until the people that run this place screw it up even worse. We have had quite a few layoffs in the Bay Area, but I suspect that at least some of those people have found alternative employment, perhaps even working remotely (which of course compounds the inventory problem). Others are likely hanging on and burning up savings, selling stock, etc., in order to stave off what might become the inevitable. Adjustment takes time (unless we have a Black Swan event), so be patient if you can. |

|

|

Appreciate

0

|

| 05-10-2023, 05:23 PM | #7925 |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Folks housing supply is fundamentally tight now because of 10 years of under building after the GFC.

Stimulus, inflation, unemployment and sunspots have nothing whatever to do with actual physical lack of supply. This is where the residential real estate market is in this country. The details are different on a neighborhood-by-neighborhood basis, but the overall story is lack of supply. More dwelling units need to be constructed. That's all. |

|

Appreciate

1

RickFLM411854.50 |

| 05-10-2023, 06:32 PM | #7926 | |

|

Major General

3654

Rep 9,783

Posts |

Quote:

|

|

|

Appreciate

1

vreihen1620784.50 |

| 05-10-2023, 09:54 PM | #7928 | |

|

Brigadier General

4830

Rep 3,611

Posts |

Quote:

You should've heard the doom and gloom guys in the early 1980s. The end of the world was always just around the corner, and they were ready to sell you "seminars" and books so you could know just what was going to happen and when. Many of those alarmists were focused on the nation's debt. Their perspective wasn't necessarily incorrect – they were just a few decades early.

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

|

|

Appreciate

1

Tyga113515.00 |

| 05-10-2023, 09:56 PM | #7929 |

|

Major General

3654

Rep 9,783

Posts |

Not sure if you’re referring to the housing or stock market. To be fair the housing market CRATERED between 2008-2011. People argue that this time it’s different because of no subprime loans, but while the causes might be different, the results will likely be the same. If housing is simply unaffordable to the masses, they will move elsewhere and then all that’s left are folks with money and homes in an area with no people to collect rent from. Something’s gotta give. It simply isn’t sustainable.

|

|

Appreciate

3

|

| 05-11-2023, 08:39 AM | #7930 | |

|

Major General

10866

Rep 9,053

Posts |

Quote:

5 years ago before we went haywire with demand... there was 0 shortage of supply, houses took months to half a year to sell... now suddenly 3 years later, we switch to very cheap money policy, COVID which was very poorly managed, stimulus, a 2% fed funds rate and demand skyrocketed... this was compounded by FOMO... all of this pushed demand 5 years forward it is true we didn't have that great of a supply to start but none of that would have caused the headaches that we have now that are multiplied by cheap money policy if the govt cared about the people... all tax stimulus should now be going towards construction of new homes and balancing supply... its not happenning because they are more concerned with propping prices and making wealthy folks wealthier

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

1

JMcLellan2742.00 |

| 05-11-2023, 08:41 AM | #7931 | |

|

Major General

10866

Rep 9,053

Posts |

Quote:

today, that is tough for two folks making 150K a year... if you think this is sustainable or in any way realistic to keep going, then good luck because you won't even have renters soon as prices continue to climb... the end of 20 years of cheap money will entirely shift dynamics... wage growth over the past 10 years has been a joke vs the cost of living... houses in my area in FL are double 3 years ago... double...

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

1

DrFerry6957.50 |

| 05-11-2023, 04:32 PM | #7932 |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Added to 5 existing equity positions. Scraped out a gain for the day.

|

|

Appreciate

1

antzcrashing1966.50 |

| 05-11-2023, 04:35 PM | #7933 | |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

30 years ago was 1993 so data is available. Which types of positions in the grocery store paid well enough to support homeownership? |

|

|

Appreciate

0

|

| 05-11-2023, 04:48 PM | #7934 | |

|

Major General

10866

Rep 9,053

Posts |

Quote:

today median house price is 430k and median salary is 69k you can see the ratio changing drastically there... median publix store manager salary is 75k... they aren't getting approved for a 430k loan a grocery store manager in 1993 could buy a home easily... in fact, I know quite a few that did

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

| 05-11-2023, 07:57 PM | #7935 | |

|

Brigadier General

1967

Rep 3,258

Posts

Drives: 2018 BMW 440i GC

Join Date: Sep 2007

Location: Eastern MA

|

Quote:

Its not Its an excuse for stocks to go down when in truth, banks are fucked by higher interest rates for a multitude of reasons Meanwhile home prices continue to climb Great job having affordable housing in America Even SP500 is basically at its trend line. (Excluding covid BS years) |

|

|

Appreciate

1

chassis8070.50 |

| 05-11-2023, 07:58 PM | #7936 | |

|

Brigadier General

1967

Rep 3,258

Posts

Drives: 2018 BMW 440i GC

Join Date: Sep 2007

Location: Eastern MA

|

Quote:

|

|

|

Appreciate

1

chassis8070.50 |

| 05-11-2023, 08:02 PM | #7937 | |

|

Brigadier General

1967

Rep 3,258

Posts

Drives: 2018 BMW 440i GC

Join Date: Sep 2007

Location: Eastern MA

|

Quote:

Thank you And to answer your question: Yes Also, I buy stocks of some companies I hate, as a hedge against them actually doing well: Uber, Google |

|

|

Appreciate

0

|

| 05-13-2023, 04:37 AM | #7938 | |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

|

|

|

Appreciate

1

vreihen1620784.50 |

| 05-20-2023, 09:26 PM | #7939 | |

|

Field Marshal

6958

Rep 1,905

Posts

Drives: '08 E92 M3

Join Date: Jul 2010

Location: Greenville, SC

|

Quote:

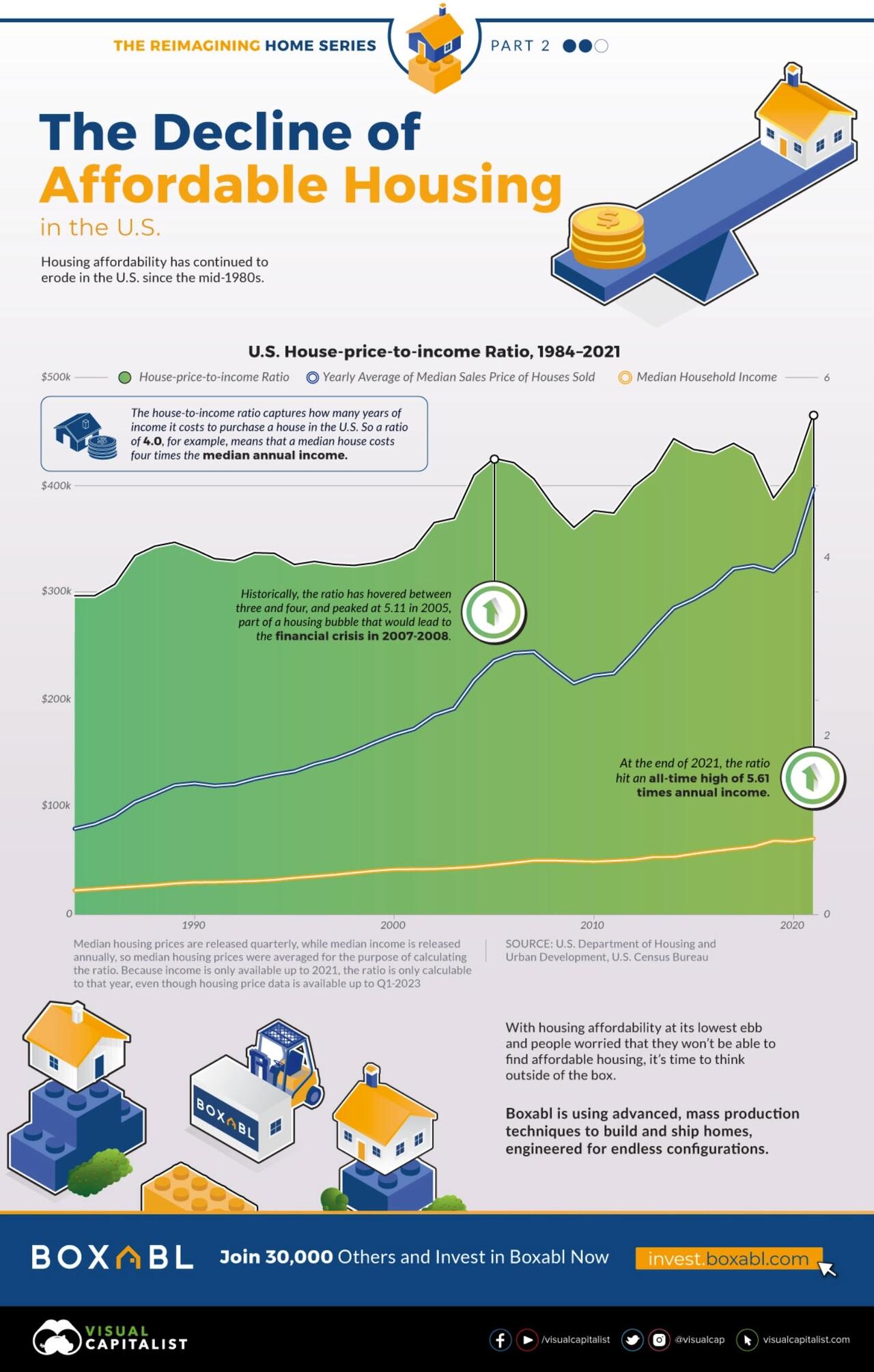

.  . Visualizing The Decline Of Affordable Housing In The US https://www.zerohedge.com/personal-f...ble-housing-us

__________________

'08 E92 M3 DCT Melbourne Red/Bamboo Beige Leather/EDC/SSP Spec-R DCT clutch discs/SSP Pro-Gold DCT Fluid/Quaife LSD/3:45 Final Drive by Diffs Online/BE Bearings & ARP Bolts/Vibra Technics Engine Mounts/LUX H8 180/DCT Tune by BPM Sport/PFC Z-Rated Pads/ECS Brass Brake Caliper Bushings/Alex Shop Solid Sub-frame Bushings/Motul 600/Tint

|

|

|

Appreciate

1

M5Rick69072.00 |

| 05-21-2023, 11:01 AM | #7940 |

|

Private First Class

1322

Rep 135

Posts |

|

| 06-03-2023, 09:15 AM | #7942 |

|

Colonel

8071

Rep 2,500

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|