bimmerpost/

G87 / G42

BMW M2 and 2-Series Coupe

| 03-30-2011, 10:49 PM | #1 |

|

Skittles, OT OG

2343

Rep 649

Posts |

Anyone good at Statistics?

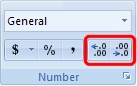

I've run into a problem that I can't seem to figure out. I'm working on a case study that deals with normal distribution. Our professor wants us to use excel to get our answers but when I put the formula in excel, I get a different answer than I do by doing it by hand. I'll explain.

The mean and standard deviation are already given. There are a few numbers that you need to plug in for X. The excel command is =NORMDIST(x,mean,standard deviation,1) To solve it by hand, you need to find the z score with the given values. The formula for that is z = (x-mean)/standard deviation then you take the z score and look it up on the chart to find the percentage. With that being said, I'll give you an example of one of the problems. x = 20%, mean = 8.8% and the standard deviation = 5.98%. Plug the values into excel and the answer is 0.969459572. Do the math by hand (.2-.088)/.0598 which gives you a z score of 1.87. Then look it up on the chart and it is .4693 .97 and .47 are two completely different numbers. Anybody know what I'm doing wrong? Below is the assignment if you need further clarification. Thanks "Question One (twenty points) You are hired as a consultant by the Alliance Financial Company. Alliance’s chief financial officer (CFO), Ms. Gail Roberts, has asked you to aid her in determining the appropriateness of a number of different investment categories for several Alliance customers. The table below shows the mean return and the standard deviation for nine different investment classes of investments sold by Alliance over the last 10 years. It is known that the returns follow a normal distribution. Investment class Mean Return (%) Standard Deviation (%) Fixed annuities 8.31 0.54 Cash equivalents 7.73 0.81 U.S. Treasury bonds 8.80 5.98 U.S. Investment-grade corporate bonds 9.33 7.92 Non-U.S. government bonds 10.95 10.47 Domestic large cap stocks 11.71 15.30 International equities 14.02 17.16 Domestic mid-cap stocks 13.64 18.19 Domestic small cap stocks 14.93 21.82 (i) Ms. Roberts has asked you to develop a table with some information that could be used in generating recommendations for different customers. Specifically, what she would like to know for each investment class is: what is the probability of a return for (1) Greater than 5%, (2) Greater than 20%, (3) Greater than 50%, (4) A loss (a return of less than 0) (5) A loss of more than 10%, and (6) A loss of more than 20% Summarize the results in a table format" |

| 03-30-2011, 10:50 PM | #2 |

|

Banned

498

Rep 10,309

Posts

Drives: A///MERICAN!!!

Join Date: Mar 2010

Location: A///MERICA!!!

|

If this can wait until tomorrow morning when my wine blood content isn't what it currently is I can probably help you on this.

|

|

Appreciate

0

|

| 03-30-2011, 10:53 PM | #4 |

|

Banned

498

Rep 10,309

Posts

Drives: A///MERICAN!!!

Join Date: Mar 2010

Location: A///MERICA!!!

|

PM right

|

|

Appreciate

0

|

| 03-30-2011, 10:55 PM | #6 |

|

Banned

498

Rep 10,309

Posts

Drives: A///MERICAN!!!

Join Date: Mar 2010

Location: A///MERICA!!!

|

OK. I'll see what I can do tomorrow

|

|

Appreciate

0

|

| 03-30-2011, 10:59 PM | #8 |

|

Skittles, OT OG

2343

Rep 649

Posts |

Thanks.

Also, for anyone else that wants to try, when I do a lot of the functions in excel, I'm getting a lot of 1's and 0's as answers. Not sure why. |

|

Appreciate

0

|

| 03-30-2011, 11:04 PM | #9 |

|

Banned

498

Rep 10,309

Posts

Drives: A///MERICAN!!!

Join Date: Mar 2010

Location: A///MERICA!!!

|

|

|

Appreciate

0

|

| 03-30-2011, 11:33 PM | #11 |

|

Banned

498

Rep 10,309

Posts

Drives: A///MERICAN!!!

Join Date: Mar 2010

Location: A///MERICA!!!

|

In the meantime check your decimal places (simple stuff has confounded me before as well)...this week has been slow I'll take a look tomorrow

|

|

Appreciate

0

|

| 03-30-2011, 11:55 PM | #12 |

|

Fapmin

435

Rep 2,660

Posts |

Check www.khanacademy.org

|

|

Appreciate

0

|

| 03-30-2011, 11:56 PM | #13 |

|

Captain

51

Rep 714

Posts |

the .47 number only represents the area to the right of the mean, you need to add .5 to it if you want the cumulative percentage (note: .47+.5=.97). Excel returns the whole thing, but with the formula, you need to "finish it off" so to speak. See if the graph below makes it clear, if not I'll try to explain more tomorrow.

__________________

Black Dakota | Aluminum | Sport | Premium | Cold | iDrive | CA

|

|

Appreciate

1

mdf279.50 |

| 03-31-2011, 12:02 AM | #14 | |

|

Captain

51

Rep 714

Posts |

Quote:

__________________

Black Dakota | Aluminum | Sport | Premium | Cold | iDrive | CA

|

|

|

Appreciate

0

|

| 03-31-2011, 12:23 AM | #16 |

|

Skittles, OT OG

2343

Rep 649

Posts |

Ok, here's a more detailed post. I think I figured out the problem. You need to subtract 1 from the equation on excel to get the probability. But I still don't understand why I'm getting 1's, 0's and other weird numbers. Doing it by hand doesn't work either. The z scores are completely off the chart. I'll incude the case study and the work I've done.

I appreciate the responses guys. Thanks |

|

Appreciate

0

|

| 03-31-2011, 12:26 AM | #17 | |

|

Skittles, OT OG

2343

Rep 649

Posts |

Quote:

|

|

|

Appreciate

0

|

| 03-31-2011, 12:32 AM | #18 | |

|

Skittles, OT OG

2343

Rep 649

Posts |

Quote:

|

|

|

Appreciate

0

|

| 03-31-2011, 12:49 AM | #19 |

|

Captain

129

Rep 778

Posts |

Statistics major here. PM me with your questions in the future, I can always use practice to not forget the beginning stuff.

"You never know if you really know something unless you can successfully teach it to someone that really doesn't want to be there." - Some grad student in the stats department |

|

Appreciate

0

|

| 03-31-2011, 12:57 AM | #20 | |

|

Skittles, OT OG

2343

Rep 649

Posts |

Quote:

|

|

|

Appreciate

0

|

| 03-31-2011, 09:00 AM | #21 |

|

Banned

498

Rep 10,309

Posts

Drives: A///MERICAN!!!

Join Date: Mar 2010

Location: A///MERICA!!!

|

Looks like you got this figured out. Zell is much better at statistics than I am...more of an occasional dorky hobby for me and took a fair amount in undergrad...but yea I've seen some of Zell's posts and he knows whats up.

|

|

Appreciate

0

|

| 03-31-2011, 09:01 AM | #22 |

|

WTF are you looking at?

255

Rep 1,560

Posts |

B's pants shrink when he sees statistics...

__________________

"It is better to be hated for what you are than loved for what you are not."

-André Gide |

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|